New page content goes here

If You:

-

Are Currently Insured

-

Are Over The Age Of 30

-

Drive Less Than 70 Miles Per Day

-

Live In A Qualified Zip Code

Then you may qualify for one of the highest auto discounts the nation has seen in the last 12 years. If you have not had a traffic ticket in the last 3 years or do not have a DUI on your record, you may get an even larger discount.

Has Your Insurance Company Bothered To Tell You About This?

Marisol’s insurance company did not.

She needed to save some money on bills after she and her husband retired from the post office. Her old boss was always great with money so she reached out for advice.

He looked over her bills and saw she was paying triple what he paid for insurance yet she drove fewer miles than him and had fewer tickets than he did. He told her she needed to fix this ASAP.

Her husband Javier usually handled all the insurance bills but he had the flu and was in no shape to call anyone. So Marisol was forced to do her own research.

Marisol entered her zip code at Smartfinancial.com and was truly stunned when she saw how much more expensive her local insurance agency had been for the last 8 years.

"I used them to see if I could get a better price on insurance. I've been with my current provider, but after speaking with 2 insurance agents was able to lower my bill by $500." , wrote Shannon P. in her review on SiteJabber.com 1 .

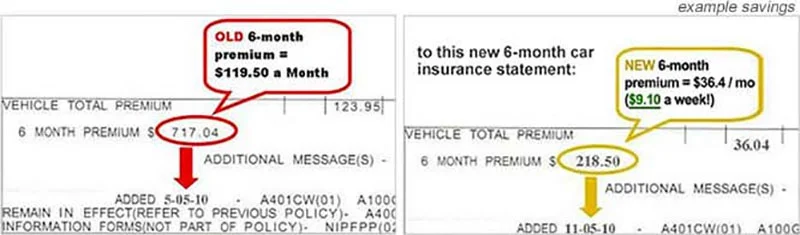

When adults go to trusted sites they get an unbiased view of the best rates in their area that INCLUDE any and all local and state discounts. Current data shows you could save up to $610 a year on car insurance.

Here is the lesson to learn – NEVER buy insurance without comparing rates on sites that are unbiased AND include updated auto rates which factor in eligible discounts.

As an authority on everything insurance, we decided to put this service to the test and after entering our zip code and driver information we were shocked at the results we found.

Note: You're NEVER LOCKED into your current policy. If you've already paid your bill, you can very easily cancel, and be refunded your balance.

Here's How You Do It

Step 1: Answer Questions Answer some questions about yourself and the insurance coverage you want.Step 2: Compare Rates They'll sort through over 200 insurance companies and find the best rates available in your area. They'll even check for discounts.Step 3: Find Coverage Review the offers and find the coverage that is right for you. The best part is that it’s 100% free and only takes a few minutes.